Homeowners in Bryan County, Georgia may qualify for valuable property tax savings through the Homestead Exemption. Whether you live in Richmond Hill, Pembroke, or unincorporated Bryan County, filing correctly—and on time—can significantly reduce your annual property tax bill.

This guide explains how the Bryan County Homestead Exemption works, who qualifies, how to apply, and what homeowners should know about special exemptions for seniors, military members, disabled veterans, and surviving spouses.

For a broader overview of statewide eligibility rules and filing deadlines, homeowners may also want to review our Georgia Homestead Exemption guide.

What Is the Homestead Exemption in Bryan County?

The Bryan County Homestead Exemption reduces the assessed value of your primary residence, which can lower the amount of property taxes you owe each year. While Georgia law governs homestead exemptions statewide, the exemption amounts and eligibility details vary by county and municipality.

Once approved, most homeowners do not need to reapply annually as long as ownership and residency do not change.

Who Qualifies for the Bryan County Homestead Exemption?

To qualify for a homestead exemption in Bryan County, homeowners must meet the following requirements:

- You must own and occupy the home as your primary residence

- The home must be occupied for 181 days or more

- Residency must be established as of January 1 of the tax year

- You may not claim a homestead exemption on another property

If you move, change ownership, or alter the exemption classification, reapplication may be required.

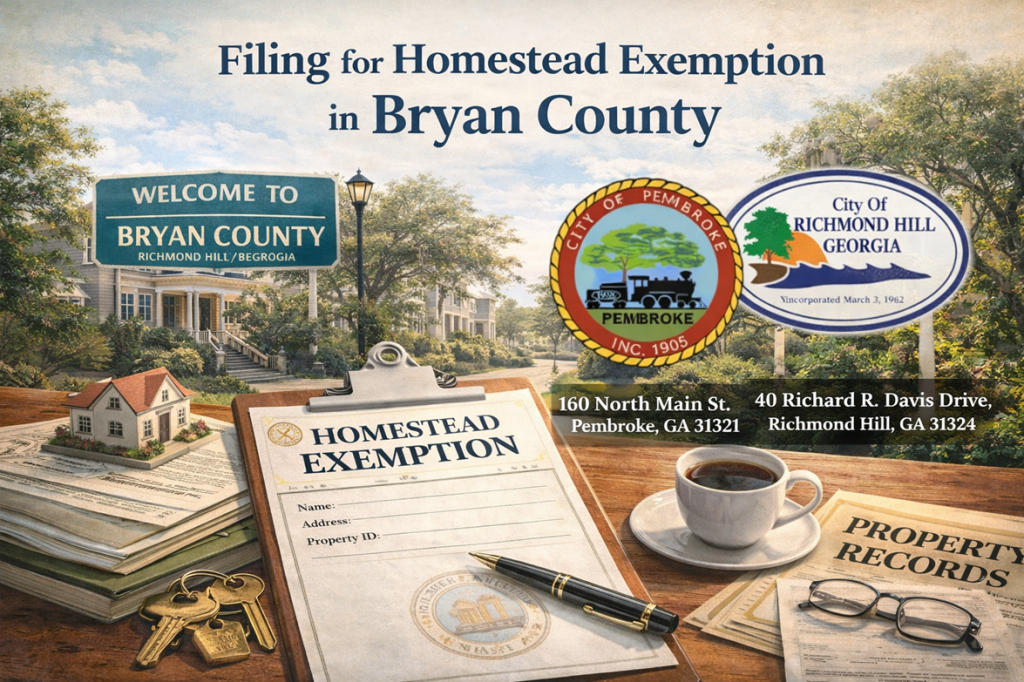

How and Where to Apply for Homestead Exemption in Bryan County

Application Locations

Homestead Exemption applications are collected at the Bryan County Tax Commissioner’s Office (Tag Office) at the following locations:

Richmond Hill Office

40 Richard R. Davis Drive

Richmond Hill, GA 31324

Phone: (912) 756-3345

Pembroke Office

160 North Main Street

Pembroke, GA 31321

Phone: (912) 653-4413

You may also obtain a pre-printed application from the Tax Commissioner’s Office or complete a blank Homestead Exemption Application available through Bryan County.

For additional confirmation on Bryan County’s filing requirements and office locations, local real estate attorney Joel Gerber has published a helpful overview outlining where and how Bryan County homeowners can file for the homestead exemption.

Filing Deadline

Applications must be filed by April 1 of the tax year to apply to that year’s tax bill.

Applications submitted after April 1 will apply to the following tax year.

Standard Homestead Exemptions in Bryan County

Individuals Under Age 65

- $30,000 local exemption for County Ad Valorem taxes

- $2,000 exemption for the school portion of Ad Valorem taxes

Senior Homestead Exemptions (Effective January 1, 2007)

Individuals Age 65 and Older

- $50,000 local exemption for County, City, and School Board taxes

- This equals $125,000 of appraised value not taxed

- Applicants must meet standard homestead qualifications

Income-Based Homestead Exemption (Age 62)

Individuals Age 62 With Net Income Under $10,000

- Total household income must be under $10,000

- Proof of age and prior year income required

- 100% exemption on the state portion of Ad Valorem taxes (up to 10 acres)

- $2,000 exemption on remaining assessed value

Military Homestead Exemptions in Bryan County

Military homeowners may qualify if one of the following applies:

- You or your spouse pay Georgia income tax, and/or

- Your legal residence / home of record is Georgia

All military applicants must complete the Military Homestead Questionnaire.

Disabled Veterans & Surviving Spouse Exemptions

Disabled Veterans

- $117,014 exemption off assessed value

- Applies to state, county, city, and school taxes

- Award letter required

Un-remarried Surviving Spouses

- Same exemption applies for:

- U.S. service members killed in action

- Disabled veterans

- Firefighters or peace officers killed in action (100% exemption)

Cities and Communities Covered by Bryan County

The Bryan County Homestead Exemption applies to qualifying homeowners in:

- Richmond Hill

- Pembroke

- Unincorporated areas of Bryan County

Tax rates may vary slightly by municipality and school district.

Why Filing Correctly Matters

Filing the correct homestead exemption—and choosing the proper exemption category—can result in thousands of dollars in long-term tax savings. Mistakes or missed deadlines may delay or reduce benefits.

If you recently purchased a home or expect changes to your eligibility (such as age-based exemptions), it’s important to review your options carefully.

Need Help Navigating Bryan County Real Estate?

Understanding homestead exemptions is just one part of smart homeownership. If you’re buying, selling, or planning long-term ownership in Bryan County, working with an experienced local real estate professional can help ensure you maximize both financial and tax advantages.

📩 If you have questions about buying or owning a home in Bryan County, feel free to reach out—happy to help guide you through the process.